- #CONVERTIBLE NOTES VENTURE CAPITAL UPDATE#

- #CONVERTIBLE NOTES VENTURE CAPITAL PLUS#

- #CONVERTIBLE NOTES VENTURE CAPITAL SERIES#

Conversion - discount and valuation capĬonvertible notes can include both a discount and valuation cap. Founders want the valuation to be as high as possible, while investors want the opposite, reducing their incentive to help a startup get to a higher valuation due to their introductions and operational support. The interests of founders and investors are misaligned if the convertible note is uncapped (we wouldn’t consider this a vanilla term). Similar to a discount, it permits the noteholder to convert their loan at a lower price than the purchase price paid by investors in the equity financing round. A cap is a ceiling on the startup's value, determining the convertible note’s conversion price. Conversion - valuation capĪ conversion valuation cap is another mechanism to reward noteholders for their investment risk. If the timeline to a qualifying round is beyond a year, it may go up to 30%. For instance, if your startup raises a qualifying round in 1 year, the investor gets a 20% discount.

The discount rate isn’t always static – it can increase. 🍦Stick to the vanilla terms Conversion - discountĪ conversion discount is a mechanism to reward the noteholders for their investment risk by granting them the right to convert the loan amount at a discount to the purchase price paid by the investors in the equity financing round.ĭiscounts typically range from 10% to 35%, the most common being 20%. We also see convertible notes used for internal bridging rounds, where the goal is to use the capital to achieve a milestone that will make the startup more attractive when it goes to raise a larger external round. This can be helpful for seed-stage startups with limited data points on traction, product and revenue or when there is no clear lead investor for the round. Using a convertible note delays the need to determine the startup’s valuation until the startup carries out an equity financing round. On the maturity date of the convertible note.

#CONVERTIBLE NOTES VENTURE CAPITAL SERIES#

company raises their Series A round from a credible external investor)

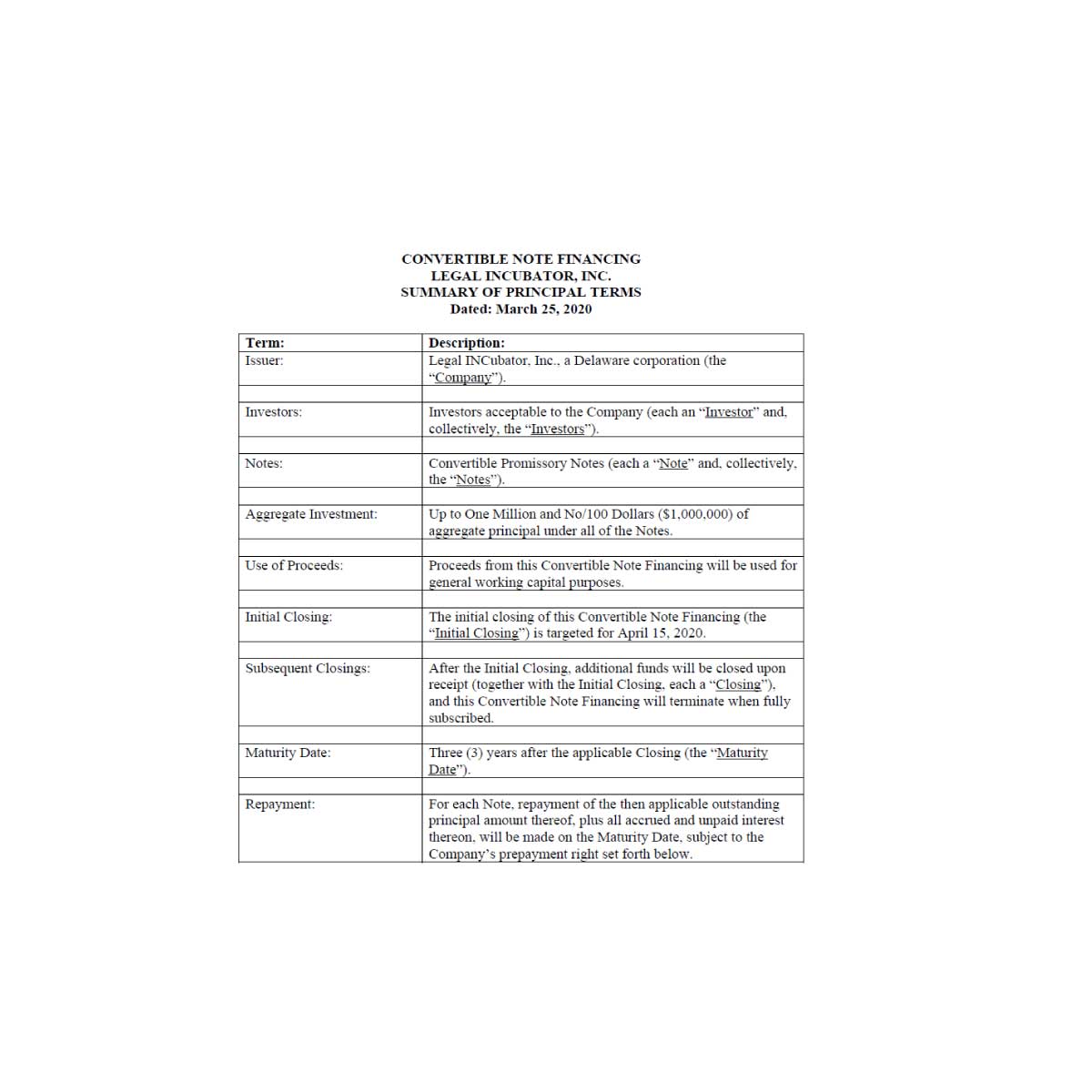

What is a convertible note?Ī convertible note is a hybrid security that converts into equity upon a predetermined trigger event.

#CONVERTIBLE NOTES VENTURE CAPITAL UPDATE#

Founders should only use it them as a starting point and then update and personalise the document (with the help of a lawyer) to ensure it meets their specific requirements and circumstances. It’s important to note that each Open Source VC convertible note is only a template. Later-stage companies will likely use more complex, bespoke, convertible note documents. We’ve purpose-built the Open Source VC convertible notes for seed and early-stage companies, meaning they have reasonably basic and straightforward terms and a balanced approach between the interests of the startup and noteholders.

#CONVERTIBLE NOTES VENTURE CAPITAL PLUS#

To get you started, here’s are our Open Source VC convertible note templates (we've prepared pre-money and post-money versions), plus a quick overview of the terms you should know. The good news is that many investors are looking to give capital to the right startup through various financing options – and one of those options is a convertible note. But from there, they need money to build and grow. Every startup begins with an ambitious founder and a great idea.

0 kommentar(er)

0 kommentar(er)